Making upgrades to your home can pay off when it comes to your home insurance premiums. Investing in certain improvements can qualify you for discounts from many insurance providers. Consider these home upgrades that could lower your insurance costs.

Install a New Roof

Replacing an old or damaged roof with a new one can significantly reduce your premiums. Insurance companies know old roofs are more susceptible to wind damage, leaks, and other costly repairs. Installing impact-resistant roofing materials like metal, tile, or fiber cement shingles can maximize your savings. Just be sure to use licensed contractors so the work is up to code.

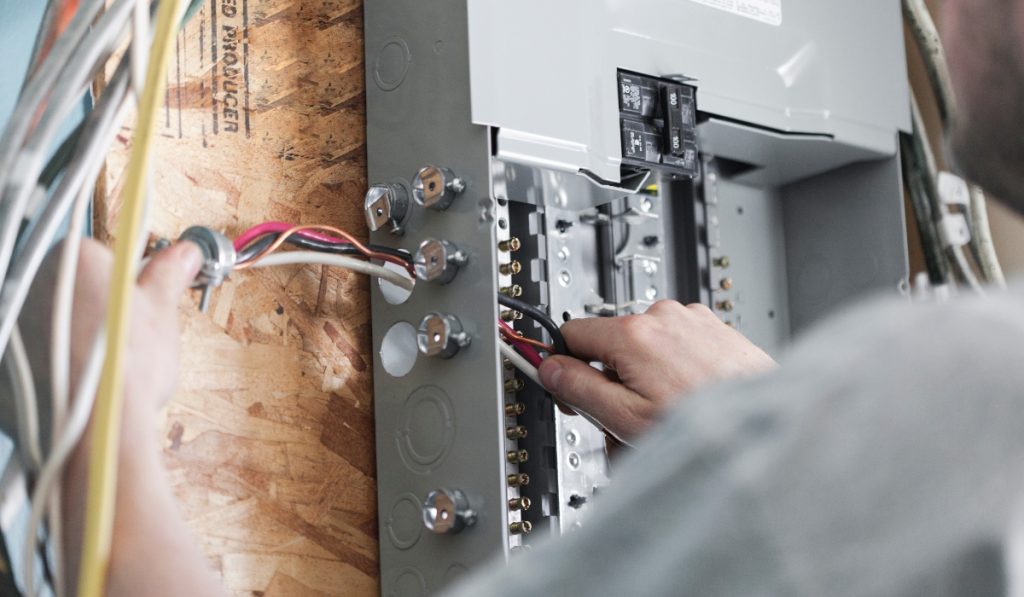

Upgrade the Electrical System

Modernizing your home’s electrical system can also net insurance discounts. Aluminum wiring is notorious for overheating and fire hazards. Replacing it with copper wiring reduces this risk. Also have a licensed electrician inspect for any other outdated wiring and upgrade electrical panels or circuit breakers to meet current safety codes. Let your insurer know about the improved electrical system.

Add Smoke and Carbon Monoxide Detectors

Properly installing and regularly testing smoke alarms, fire alarms, and carbon monoxide detectors saves lives. It also shows insurers you’re serious about home safety. Combine the alarms into a full security system for extra savings. Position detectors strategically in kitchens, bedrooms, hallways, basements, and living areas. Remember to replace batteries twice a year.

Improve Home Security

Strengthening locks, adding motion-sensor lights, installing a home security system, and securing windows and doors also earns premium discounts. Reduce burglary and vandalism risks by making it harder for intruders to enter undetected. Security cameras provide another layer of protection. Monitor all systems regularly to ensure they’re functioning properly.

Upgrade Plumbing Systems

Replacing dated steel or iron pipes with copper or plastic plumbing lowers the risk of leaks, flooding, and water damage. If your home is over 20 years old, consider re-piping the whole plumbing system. Repair any loose fittings, scale buildup, and rust spots. Water damage claims are one of the costliest for insurers, so preventing issues saves them money.

Add Water Sensors and Shut-Off Valves

Installing water sensors in key locations can alert you to any leaks or flooding issues early before major damage occurs.Smart water shut-off valves like Flo by Moen take it a step further by automatically shutting off the water supply if a leak is detected. Adding these systems makes your insurer more confident you’ll avoid expensive water claims.

Upgrade the HVAC System

Heating and cooling systems over 10 years old start to run less efficiently and are more prone to breakdowns. Replacing aging air conditioning units and furnaces with new Energy Star models lowers utility bills and improves air quality and circulation. Schedule annual maintenance to keep them running smoothly. Improved climate control reduces wear and tear on the home.

Protect Against Power Surges

Power surges from storms or faulty wiring can fry home electronics and damage major systems. Surge protectors, lighting arrestors, and ground fault circuit interrupters (GFCIs) divert excess electrical current safely away from devices and outlets. Have electricians install whole house surge protection at the breaker box. Insurers like to see protection from voltage spikes.

Conclusion

With strategic upgrades, you can bolster your home’s safety and reduce risks for your insurance provider. Talk to your agent about additional discounts you may qualify for when filing an updated home inventory reflecting new security and systems improvements. Safety-focused upgrades demonstrate your commitment to home protection and make you an ideal customer for insurance companies to take on with lower premiums.